Kyber announces $30M liquidity mining program to enhance liquidity on both Ethereum and Polygon

We are thrilled to announce that Kyber Network is launching its Dynamic Market Maker, a new protocol in Kyber’s liquidity hub, Kyber DMM on the Polygon network which is set to deploy on 30th June.

With the vision to deliver a sustainable liquidity infrastructure for DeFi, Kyber extends to Polygon and launches ‘Rainmaker’ — Kyber’s very first liquidity mining program on Polygon and Ethereum with an estimated $30M in rewards to liquidity providers to enhance liquidity on Polygon and Ethereum.

Kyber Aims to Enhance Defi Liquidity

The launch of Kyber DMM on Polygon will enable users to take advantage of Polygon’s high-speed and low-cost infrastructure during trading and liquidity provision. A portion of trading fees generated on Kyber DMM will go to KyberDAO, complementing the existing Kyber DMM protocol deployment on Ethereum.

Kyber DMM’s capital efficiency and flexible liquidity protocols can cater to Polygon’s diverse ecosystem of Dapps and DeFi use cases, and enable liquidity providers to maximize the use of their capital.

Kyber’s Rainmaker Liquidity Mining Program

With the aim to incentivize liquidity providers and developers to use Kyber DMM, Kyber launches its first-ever liquidity mining program, “Rainmaker’’ starting from 30th June which will distribute an estimated total of $30M in rewards to eligible Kyber DMM liquidity providers (LPs). Liquidity providers will receive DMM LP tokens (representing their liquidity pool share) which they can stake in the eligible liquidity mining pools to earn additional KNC or MATIC (Kyber’s & Polygon’s governance tokens) rewards on top of protocol fees during the program period.

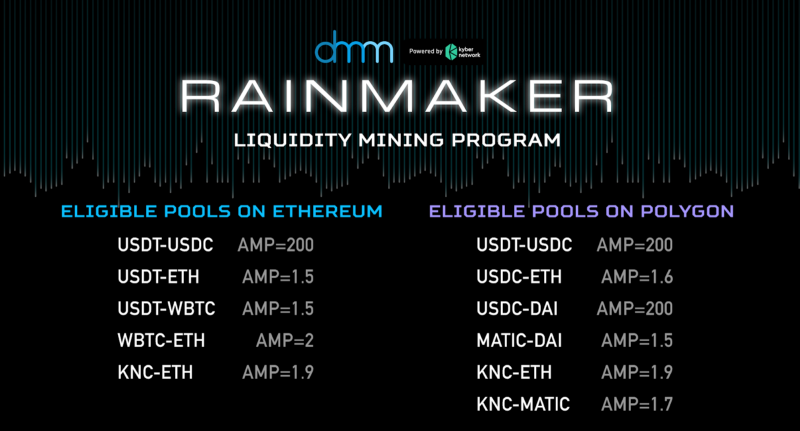

The Liquidity Mining program on Polygon will run for 2 months. Kyber and Polygon will be distributing 2.52M KNC tokens (~$5M) and $500,000 worth of MATIC tokens respectively across six eligible amplified pools:

USDT-USDC (AMP=200)

USDC-ETH (AMP=1.6)

USDC-DAI (AMP=200)

MATIC-DAI (AMP=1.5)

KNC-ETH (AMP=1.9)

KNC-MATIC (AMP=1.7)

These rewards can be used to add liquidity to the KNC or MATIC pools to earn even more rewards. In addition, KNC can be staked on KyberDAO to participate in Kyber’s governance and earn voting rewards.

For more details, click here!

Benefits of Liquidity Providers on Kyber DMM

Kyber DMM offers the following benefits to LPs:

Amplified pools

Dynamic fees

Fully permissionless

No 3rd-party oracles

Committed to security

“Liquidity is a crucial element in any DeFi ecosystem and we’re glad to work with Kyber Network to help enhance liquidity on Polygon through the Kyber DMM protocol!”

– Sandeep Nailwal, Co-founder and COO, Polygon

“Through this partnership, Polygon’s vibrant ecosystem will gain access to the highly capital efficient and flexible Kyber DMM protocol, and we believe this will empower more liquidity providers, traders, and developers to effectively engage in the world of decentralized finance.”

– Loi Luu, Co-Founder, Kyber Network

About Kyber Network

Kyber Network aims to deliver a sustainable liquidity infrastructure for DeFi. As a liquidity hub, Kyber connects liquidity from various protocols and sources to provide the best rates to takers such as Dapps, aggregators, DeFi platforms, and retail users.

Source : blog.polygon